UNDERSTANDING WHAT HAPPENED IN 2022

since 2008 and prices will have declined by 15-25%.

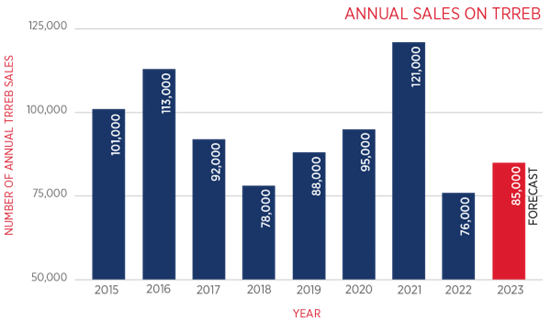

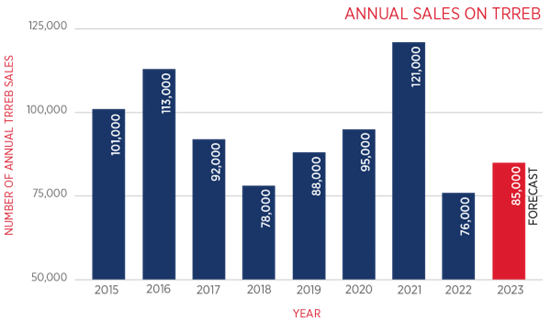

The real estate market in 2021 and up to March of 2022 was clearly unsustainable. The Bank of Canada was late to correct inflation and to deal with interest rates which were basically zero. Starting in March, they began to overcompensate in both areas and the result was the start of a market correction that no one foresaw. Sales and prices declined rapidly. Sales for 2022 will be the lowest since 2008 and prices will have declined by 15-25%.

WHAT TO LOOK FOR IN 2023

.2. Real estate sales are always a lead indicator for price increases. We are currently at historic low sale numbers. The key will be what will sales look like in March?

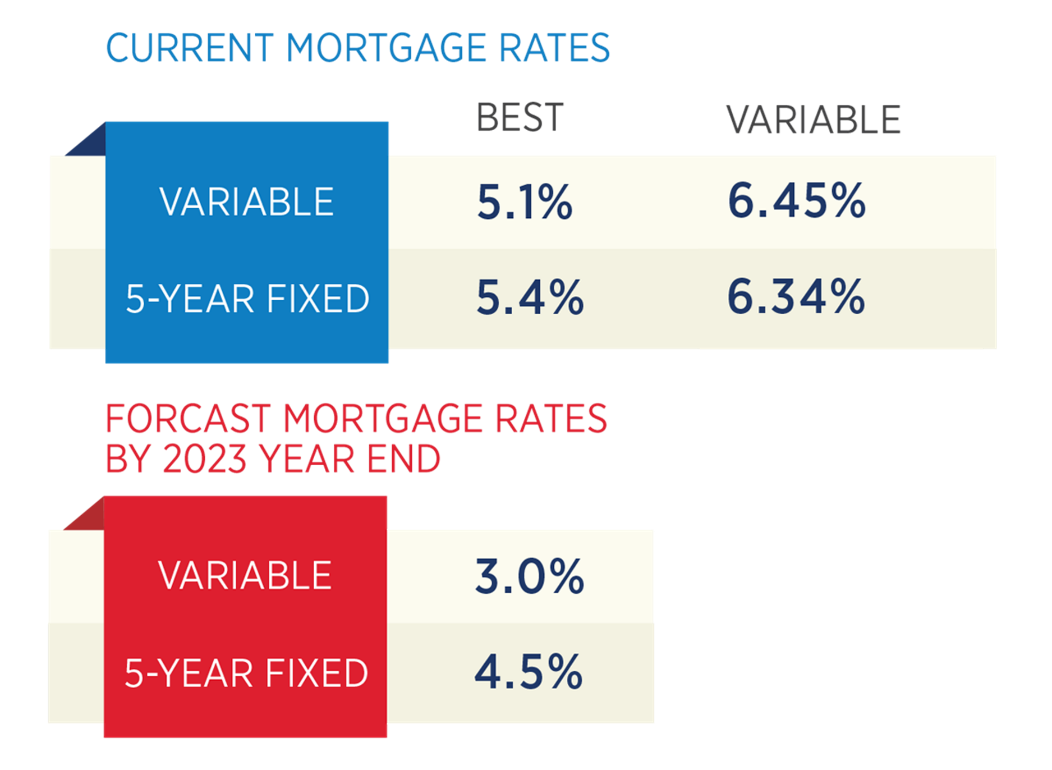

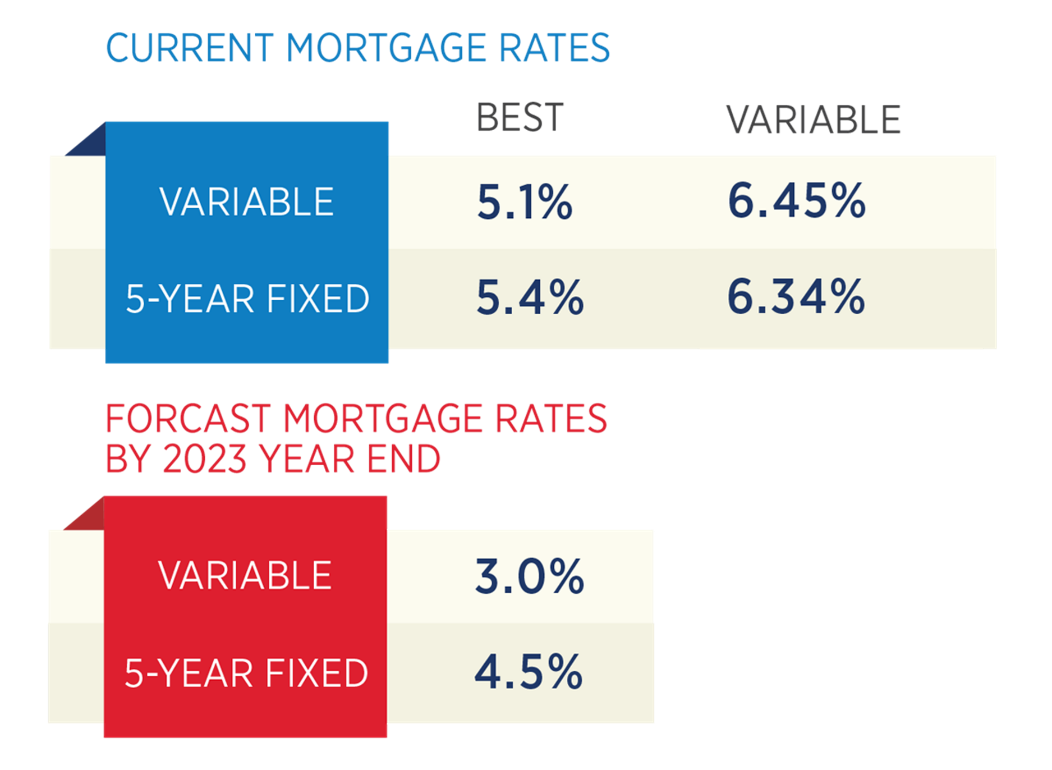

3. Look for mortgage rates to stabilize and then trend lower in the latter half of the year as the Bank of Canada is forced to modify its position to deal with rising unemployment numbers.

4. New construction coming to market in 2023 will be more expensive than the current resale market. Affordable housing is still years away, as Governments cannot agree on how to deliver it.

5. Expect Immigration to ramp up this year (450,000+), putting additional pressure on both the rental and sale markets.

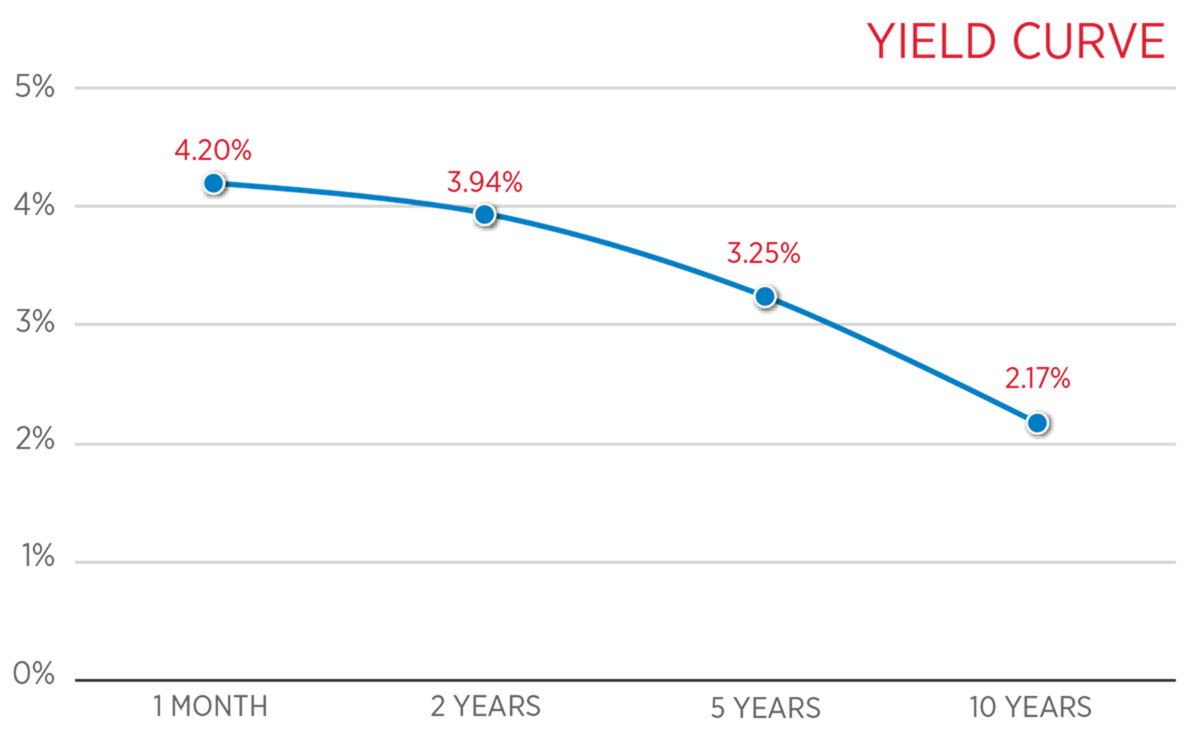

6. We are heading into a recession. While employment numbers remain high, a look at the Yield Curve below shows the severity ahead. But when?

MORTGAGE ARREARS

All banks must report ‘mortgages arrears’ as defined as over 90 days outstanding. Mortgage arrears are a lead indicator for ‘power of sale’ listings entering MLS which should produce a downward force to prices. Break down is by province only.

YIELD CURVE

PRICE CHANGES IN 2023

The real estate market in 2021 and up to March of 2022 was clearly unsustainable. The Bank of Canada was late to correct inflation and to deal with interest rates which were basically zero. Starting in March, they began to overcompensate in both areas and the result was the start of a market correction that no one foresaw. Sales and prices declined rapidly. Sales for 2022 will be the lowest since 2008 and prices will have declined by 15-25%.

Over the last 8 years, we have averaged 95,500 sales. For 2023 we are forecasting 85,000 sales due to higher mortgage rates and buyers trying to find the bottom of this market.

FORECASTS FOR 2023

MORTGAGE RATES

The more severe the recession in 2023, the farther interest rates will fall. Most of these decreases will occur in the latter half of 2023.